Smart ETF Guide 2026 – ETF vs Mutual Fund Comparison for Beginners

Introduction

When I started investing back in 2018, I only knew one word — mutual funds. Every ad said, “Mutual fund investments are subject to market risks…” and I thought that’s the only way to invest in the stock market without stress.

Then one day, a friend who works in finance told me about something called ETF. He said, “It’s like a mutual fund, but cheaper.” I was curious — but also confused. If both are for investing, why do we need two different options?

I started reading and even tried both. In the beginning, I made mistakes, lost a little money due to my timing, but later, I understood how ETFs actually work.

Now, in 2026, ETFs have become much more popular in India — especially with more people investing online. But many beginners still ask, “ETF vs Mutual Fund — which one should I choose?”

In this post, I’ll share what I’ve learned from my own experience — in simple, honest words. Let’s start from the basics.

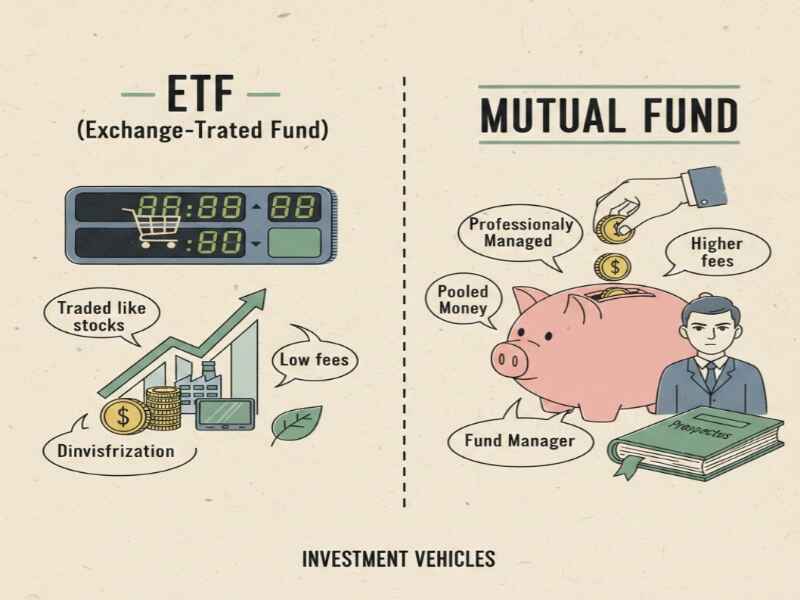

What Is an ETF (Exchange Traded Fund) ?

An ETF (Exchange Traded Fund) is a basket of shares that you can buy or sell directly on the stock market — just like a normal stock.

Imagine a big thali in a restaurant — with small portions of rice, dal, roti, and curry. You’re getting a mix of everything. That’s what an ETF does — it gives you a mix of many company shares in one go.

For example, a Nifty 50 ETF includes shares of India’s top 50 companies. So when you buy one unit of that ETF, you indirectly own small parts of all those 50 companies.

The best part? You don’t have to pick stocks yourself. And the fees are very low — that’s what caught my attention first.

When you buy an ETF, you are indirectly investing in all the companies included in that index.

What Is a Mutual Fund ?

A Mutual Fund is a basket of investments — like shares, bonds, or other assets — that many people invest in together.

Imagine a big pot where you, me, and thousands of others put our money. A professional fund manager then uses that money to buy different company shares and manage everything for us.

For example, if you invest ₹500 in an Equity Mutual Fund, your money gets divided across many top Indian companies — maybe HDFC, Infosys, and Reliance — depending on the fund’s goal.

You don’t have to track or buy individual shares. The fund manager does all that. You just invest regularly and stay patient.

It’s the easiest way for beginners to enter the stock market — without worrying about which stock to pick or when to buy.

ETF vs Mutual Fund :- Which is Better ?

When I first heard about ETFs, I thought they were just another version of mutual funds. But after using both for a few years, I realised they have their own strengths. Neither is 100% better — it depends on your goals and comfort level.

Let’s keep it simple 👇

| Feature | ETF (Exchange Traded Fund) | Mutual Fund |

|---|---|---|

| How You Buy | Buy and sell on the stock market through a Demat account | Buy directly through fund houses or investment apps |

| Price Movement | Price changes every minute during market hours | Price changes only once a day (end of market) |

| Expense Ratio (Fees) | Very low | Higher (because of fund manager fees) |

| Who Manages It | Mostly passive (tracks an index) | Actively or passively managed by a fund manager |

| Minimum Investment | 1 unit (can start with ₹50–₹100) | Usually ₹500 or more |

| Liquidity | Can sell instantly during market hours | Can redeem anytime, but money credited in 1–2 days |

| Transparency | You can see holdings daily | Portfolio updated monthly |

| Best For | DIY investors who like control and low cost | Beginners who want simplicity and expert management |

So, ETF vs Mutual Fund Which is Better ?

Here’s my honest take after trying both:

- Choose ETFs if you already have a Demat account, want lower costs, and prefer managing investments yourself.

- Choose Mutual Funds if you’re a beginner, want SIP options, and don’t want to track prices daily.

Personally, I use both. My SIPs run in mutual funds, and I buy ETFs whenever I have extra cash. That way, I get the best of both worlds — the discipline of mutual funds and the cost advantage of ETFs.

Final Tip :-

When choosing between ETF vs Mutual Fund, don’t overthink it.

Start with what feels simpler to you. You can always mix both later once you’re comfortable.

The goal isn’t to pick the “perfect” option — it’s to start early and stay consistent. That’s how real wealth grows.

How to Start Investing in ETFs (Step-by-Step)

- Open a Demat Account

If you don’t already have one, open with brokers like Zerodha, Groww, or Angel One. - Transfer Money to Your Trading Account

Add funds for your first investment. - Choose the Right ETF

For beginners, start with a simple index ETF — like Nifty 50 or Sensex ETF. - Check Volume and Expense Ratio

Higher trading volume = easier to buy/sell. Lower expense ratio = better long-term returns. - Buy During Market Hours

Place your order between 9:15 AM and 3:30 PM — just like any stock. - Hold for the Long Term. ETFs perform best when held for 3–5 years or more.

- Track Periodically, Not Daily. Don’t panic about daily ups and downs. Review once every few months.

Common Mistakes People Make with ETFs

When I started with ETFs, I made many of these mistakes myself. If you’re a beginner, avoid them.

Treating ETFs Like Stocks

I bought and sold ETFs every week thinking I could “time the market.” That never worked. ETFs are meant for long-term investing, not trading.

Ignoring Expense Ratio

Some people buy random ETFs without checking fees. Even small differences (0.1% vs 0.5%) can make a big impact in the long run.

Buying When the Market Is High

I once bought a Nifty ETF when the Sensex was at an all-time high. Within a month, it fell 8%. The lesson: invest regularly, not all at once.

Not Understanding What ETF They’re Buying

There are ETFs for gold, banks, Nifty, Sensex, and even foreign markets. If you don’t know what’s inside, you might be taking unexpected risks.

Ignoring Liquidity

Some ETFs have very low trading volume. I learned the hard way when I tried selling one — and no one was buying. Always check daily volume before investing.

My Real Experience

In 2020, I started my first ETF investment with ₹2,000 in a Nifty 50 ETF. At that time, I had already been investing in mutual funds for two years.

At first, the ETF price didn’t move much. I almost thought of selling. But I decided to stay invested. By 2024, that same investment was worth around ₹3,400 — not bad for something I barely touched.

Later, I switched half my SIPs into ETFs because the costs were lower and returns were almost the same.

Now in 2026, I hold ETFs for Nifty 50, Bank Nifty, and even a small portion in a U.S. market ETF. My total ETF portfolio is around ₹1.8 lakh — and I’m planning to keep adding slowly.

The best part? I don’t feel stressed. I check once a month and then forget about it. That’s real peace.

Limitations & Disclaimer

ETFs are not perfect. Their prices can fluctuate during the day. Some ETFs in India still have low liquidity. And unlike mutual funds, there’s no SIP option built-in — though some brokers now allow recurring buys.

Always remember: the share market carries risk. Invest only after you understand what you’re buying.

This blog is for educational purposes only, not investment advice. Please consult a SEBI-registered advisor for personalised guidance.

Frequently Asked Questions (FAQs) :

1. Are ETFs better than mutual funds ?

Not always. ETFs are cheaper but need a Demat account. Mutual funds are easier for absolute beginners.

2. What is the minimum amount to invest in ETF vs Mutual Fund ?

In ETFs, you can start with as little as one unit — sometimes ₹50–₹100. In Mutual Funds, the minimum is usually ₹500 if you’re starting a SIP or ₹1000 for a one-time investment.

3. Do ETFs give dividends ?

Some do. Check if your ETF is “dividend” or “growth” type before buying.

4. Is ETF safe ?

As safe as the index or companies it tracks. There’s always market risk, but no fund manager bias.

5. Can I sell ETFs anytime ?

Yes, during market hours. Just like shares.

6. Which is better for long-term — ETF vs mutual fund ?

Both can build wealth. Choose ETFs for lower cost, mutual funds for convenience.

Conclusion :-

After using both for a few years, I’ve realised there’s no clear winner in the ETF vs Mutual Fund debate. Both have their strengths — it’s about what suits you and your comfort level.

If you want simplicity, automatic SIPs, and expert fund management, Mutual Funds are a great place to start. You don’t need a Demat account, and everything runs smoothly in the background.

But if you prefer lower costs, more transparency, and direct control through your Demat account, ETFs make perfect sense — especially in 2026, when more Indian investors are choosing index-based investing.

Personally, I use both. My SIPs run in mutual funds for consistency, while I buy ETFs whenever I have extra cash or when the market dips. This mix gives me balance, growth, and peace of mind.

So, instead of asking “ETF vs Mutual Fund — which is better?”, ask yourself “Which one matches my habits and goals?” Because the best investment is not what others choose — it’s what you can stick with for years.

Start small, stay patient, and remember — long-term discipline always beats short-term decisions.

For more details about ETFs, you can check authoritative sources like NSE India – ETF Information