Credit Card vs Debit Card: A Complete Guide to Choose the Right Card

Introduction

If you’ve ever stood at a shop counter wondering whether to swipe your credit card or your debit card, trust me, you’re not alone. I’ve been there too. A few years ago, I had both cards in my wallet but didn’t really understand the difference. I used whichever card came to my hand first. One day, I ended up paying a late fee of ₹1,200 on my credit card bill just because I forgot the due date. That’s when I realised—credit cards and debit cards may look the same, but how they work is totally different.

In India, where online shopping, UPI, and card payments are becoming the norm, knowing how to use your cards wisely can save you money and stress. Many beginners just swipe without thinking. I did that too, and it cost me more than I’d like to admit.

So, in this blog, I’ll break down the difference between credit cards and debit cards in simple English. No fancy banking terms. Just real talk, real examples, and what I’ve learned from my own mistakes.

What is a Debit Card ?

A debit card is directly linked to your bank account. When you use it, money is deducted instantly from your available balance.

Key features of a debit card :-

- Linked to savings or current account

- Uses your own money

- Instant deduction

- Easy to control spending

- Widely accepted online and offline

Debit cards are commonly used for daily expenses like groceries, fuel, ATM withdrawals, and utility payments.

Example :- If you have ₹20,000 in your account and you spend ₹2,000 with your debit card, your balance drops instantly to ₹18,000.

💳 Benefits of Using a Debit Card :-

Debit cards keep your spending controlled because they use only the money in your bank.

1. No Debt Risk :- You only spend what you have. No interest, no bills, no overdue fees.

2. Simple & Easy :- Perfect for everyday expenses like groceries, petrol, and bill payments.

3. ATM Access :- Debit cards give you quick access to cash anytime.

4. Budget-Friendly :- Ideal for people who want to control their spending and avoid overspending.

What is a Credit Card ?

A credit card allows you to borrow money from the bank up to a certain limit. Instead of deducting money instantly from your account, you get a monthly bill with the total you owe.

Example :- If you buy a laptop worth ₹50,000 on your credit card, you don’t pay immediately. You’ll receive a bill at the end of the billing cycle and can either pay in full or in part.

Key Features of Credit Cards :-

- Borrowed money (you must repay later)

- Builds your credit score if used responsibly

- Comes with rewards (cashback, points, travel miles)

- May include purchase protection and insurance

- Interest applies if you don’t pay the full bill on time

👉 Credit cards act like a short-term loan with benefits—but can also trap you in debt if misused.

💳 Benefits of Using a Credit Card :-

Credit cards offer more protection and flexibility—especially when you manage them wisely.

1. Build Your Credit Score :- Every swipe helps you build a strong credit history, which can get you better loans and lower interest rates in the future.

2. Extra Security :- If your card gets stolen or misused, most banks offer zero liability protection. Fraud charges can be reversed easily.

3. Rewards and Cashbacks :- From travel points to dining discounts—credit cards often give better rewards than debit cards.

4. Buy Now, Pay Later :- You can pay your bills in a 30–45 day cycle. This gives you more time and flexibility to manage your money.

⚖️ Summary :- Credit Card vs Debit Card Which One Wins ?

Credit Cards = Best for rewards, safety, building credit, and smart financial planning.

Debit Cards = Best for controlling spending and staying debt-free.

Both are useful—your choice depends on your money habits.

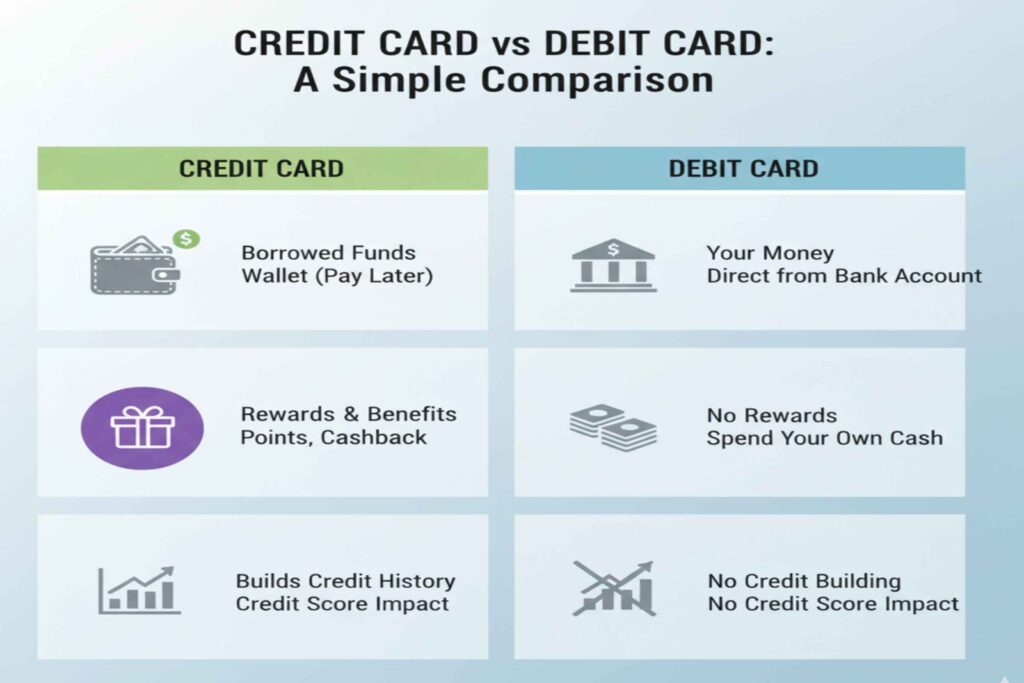

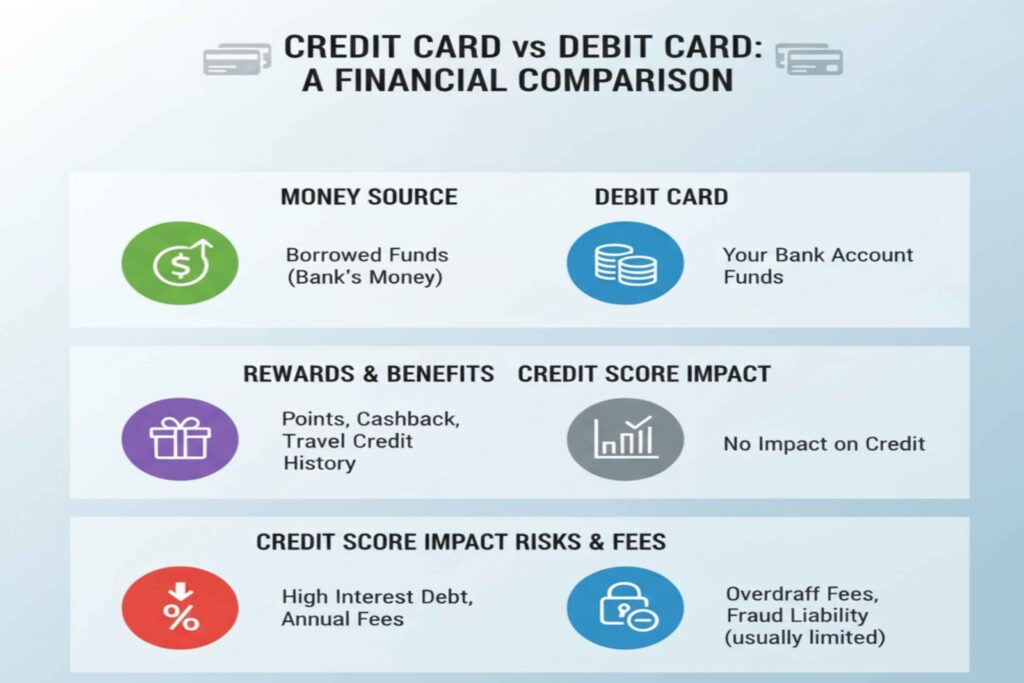

Credit Card vs Debit Card :- Key Differences Explained

Here are the most important differences :-

| Feature | Credit Card | Debit Card |

|---|---|---|

| Money Source | Borrowed money | Your bank balance |

| Interest | Yes (if unpaid) | No |

| Credit Score Impact | Yes | No |

| Spending Limit | Credit limit | Account balance |

| Rewards | Usually available | Limited |

| Risk of Debt | High (if misused) | Low |

Credit Card vs Debit Card :- Risks You Should Know

Both cards are useful, but each comes with its own risks. Understanding them helps you use your money smarter and avoid costly mistakes.

⚠️ Risks of Using a Credit Card :-

1. Overspending Is Easy :- Because you’re not paying immediately, many people swipe more than they can actually afford. This can lead to big monthly bills.

2. Interest Charges and Late Fees :- If you don’t pay your bill on time, high interest starts adding up. Even one mistake can become expensive.

3. Debt Trap Risk :- Missing payments + high interest = long-term debt. A few months of ignoring bills can affect your financial life for years.

4. Credit Score Damage :- Late payments or high credit usage can lower your score. A low score makes loans, EMIs, and credit cards harder to get.

5. Annual Fees / Hidden Charges :- Some banks add membership fees, renewal fees, or late penalties that many users don’t notice.

⚠️ Risks of Using a Debit Card :-

1. Direct Bank Balance Impact :- Money is deducted immediately. If your card details are stolen, your actual bank account is at risk.

2. Weak Fraud Protection :- While credit cards offer stronger chargeback support, debit card refunds may take longer.

3. No Credit Score Benefit :- Using a debit card doesn’t help build a credit score, which you need for loans or EMIs.

4. Limited Rewards / Offers :- Debit cards offer fewer benefits, meaning you miss out on cashback or travel points.

5. Daily Spending Limits :- Banks put caps on how much you can spend daily. This may be inconvenient in emergencies.

Credit Card vs Debit Card: Which Is Better for Beginners ?

For beginners, debit cards are usually safer because:

- No borrowing involved

- No interest or bills

- Easier spending control

However, a low-limit credit card can be useful for:

- Building credit score

- Online payments

- Learning responsible credit use

The best choice depends on your financial habits.

Can You Use Both Credit and Debit Cards ?

Yes, many financially smart people use both.

Example strategy:

- Debit card → daily expenses

- Credit card → planned purchases + rewards

Balanced usage gives flexibility and control.

Real Personal Example

Let me share a story from 2023.

I was planning a short Goa trip with friends. Flights and hotel costs together were around ₹18,000. I didn’t want to touch my savings, so I used my credit card. The plan was to repay in the next salary cycle.

But that month, an unexpected expense came up—my bike insurance renewal of ₹4,500. I couldn’t clear the full credit card amount. I paid only ₹8,000 thinking it was fine. Next month, my statement showed ₹650 as interest and ₹400 late fee.

That’s when I realised—credit cards are helpful only if you pay the full bill. Since then, I’ve made it a rule: I use my credit card only when I’m 100% sure I can repay next month.

Now, I use my debit card for daily stuff and credit card only for planned spending. This simple switch has saved me a lot of stress (and money).

Limitations & Disclaimer

This blog is based on personal experience and general financial habits in India. It’s for educational purposes only. Everyone’s financial situation is different, so always review your bank’s terms before applying or using a card. This is not financial advice.

FAQ :- Credit Card vs Debit Card

1. Which is safer — credit card or debit card?

Credit cards are usually safer for online purchases because your money isn’t deducted instantly.

2. Can I build credit using a debit card?

No. Only credit card usage impacts your credit score.

3. What happens if I don’t pay my credit card bill?

You’ll be charged interest and late fees, and your credit score will drop.

4. How can I control my credit card spending?

Set spending limits in your bank app or use your credit card only for essentials.

5. Should I keep both cards?

Yes. Use your debit card for daily expenses and your credit card for planned payments.

6. Can students get credit cards?

Some banks offer student-friendly credit cards or add-on cards with low limits.

Conclusion :-

Understanding the difference between credit and debit cards can completely change how you handle money. I learned it the hard way—through late fees and financial stress. But you don’t have to.

Start simple. Use your debit card for daily life and your credit card for planned, repayable purchases. Pay your bills on time, track your spending, and you’ll start feeling more in control of your money.

Money management doesn’t have to be complicated. Once you understand your cards, you’ll feel confident every time you swipe.

HDFC Bank resource: “Difference Between Credit Card vs Debit Card” —

You can also read this :-

10 Powerful Ways to Improve Credit Card Score Fast | How to Build My Credit Card